For the past few years, gold has been treading water with no clear direction and causing even the most die-hard gold bugs to scratch their heads in confusion regarding the yellow metal's next major move.

Gold has been climbing up a long-term uptrend line that formed in the early-2000s.

From a technical perspective, gold will remain in a confirmed long-term uptrend as long as it stays above that uptrend line - after all, a trend in motion tends to remain in motion.

When currencies were backed by gold, it was impossible to dilute them the way that paper currencies are diluted because every currency unit was required to have a certain amount of gold backing it up and it's impossible to print or conjure gold out of thin air.

If gold's price lags money supply growth there is a good chance that gold will soon experience of period of strength.

To summarize, gold began a powerful uptrend in the early-2000s and it is still in that same uptrend despite the choppy price action of the past few years.

Though the paper money supply will increase exponentially in the years ahead, the supply of physical precious metals like gold and silver will remain relatively constant in comparison, which is a recipe for much higher gold and silver prices.

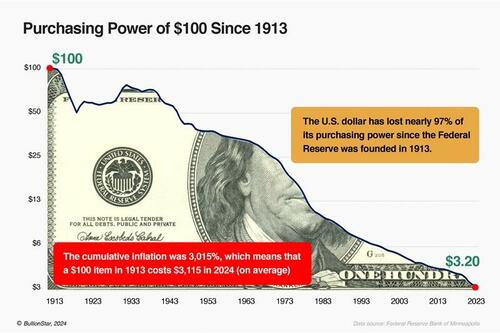

American currency has lost a jaw-dropping 97% of its purchasing power with no end in sight. As long as the U.S. dollar remains an unbacked fiat currency, it is going to keep losing purchasing power as a function of time.

https://www.zerohedge.com/commodities/evidence-and-insights-about-golds-long-term-uptrend

No comments:

Post a Comment